A specialist intelligence advisory

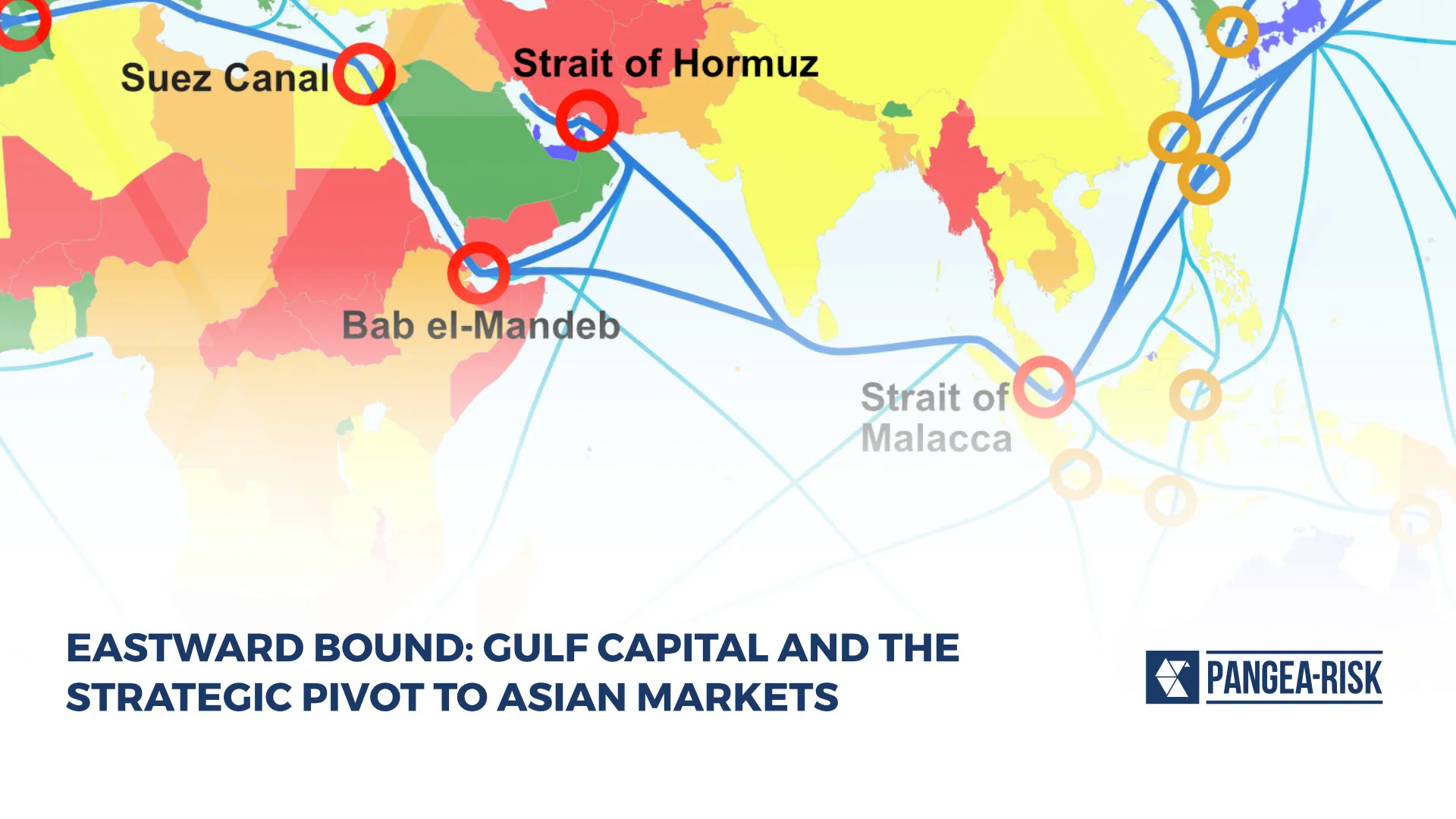

Country risk forecasting solutions to mitigate threats and maximise opportunities

in emerging and frontier markets across Africa, Asia, and the Middle East.

In a complex and multi-polar world, your risk management strategies should go beyond merely avoiding risk.

Be risk aware.

Mitigate country risk with Insight.

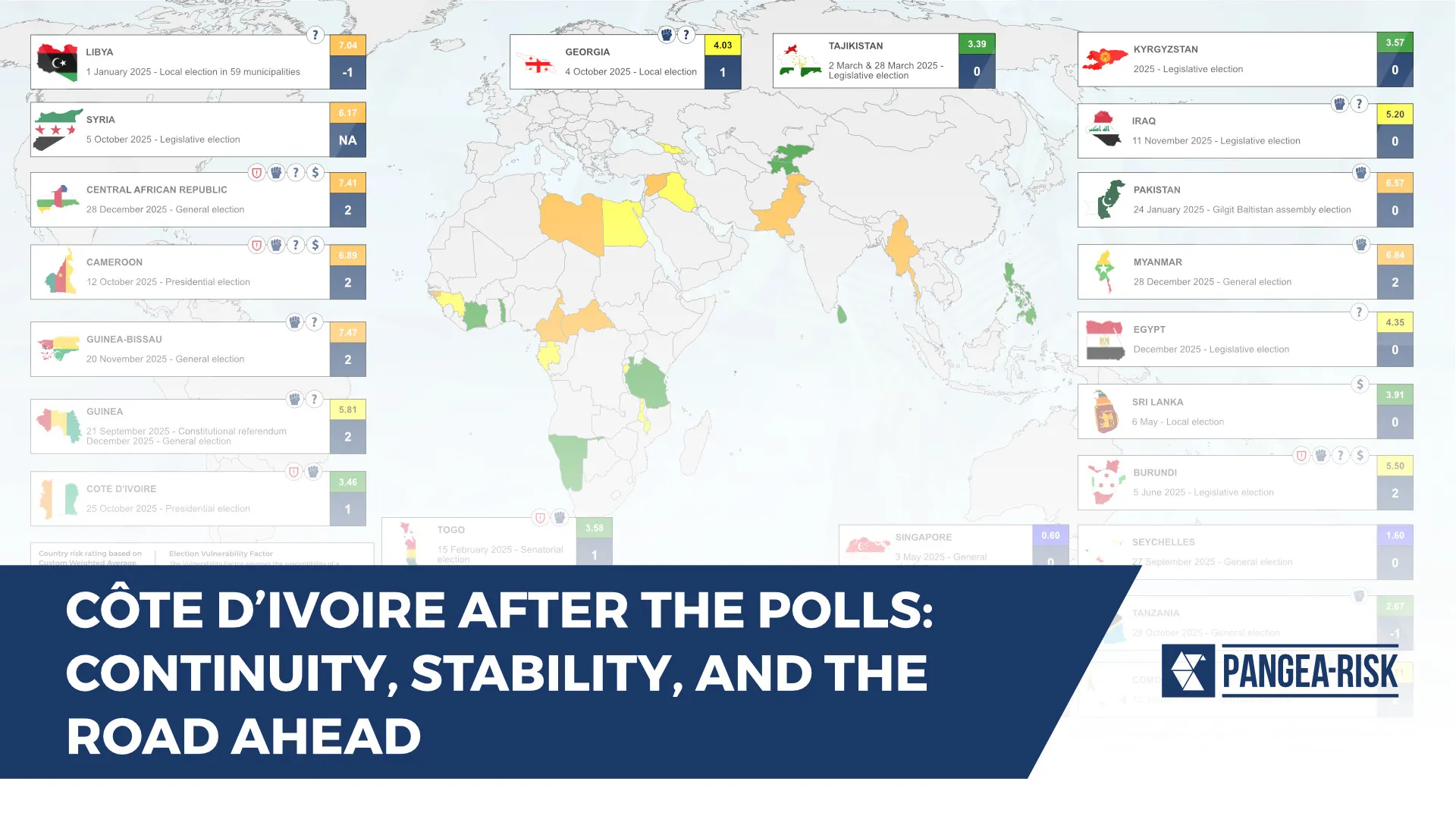

We focus on country risk in emerging and frontier markets to create a sustainable competitive advantage for our clients across a broad spectrum of industries.

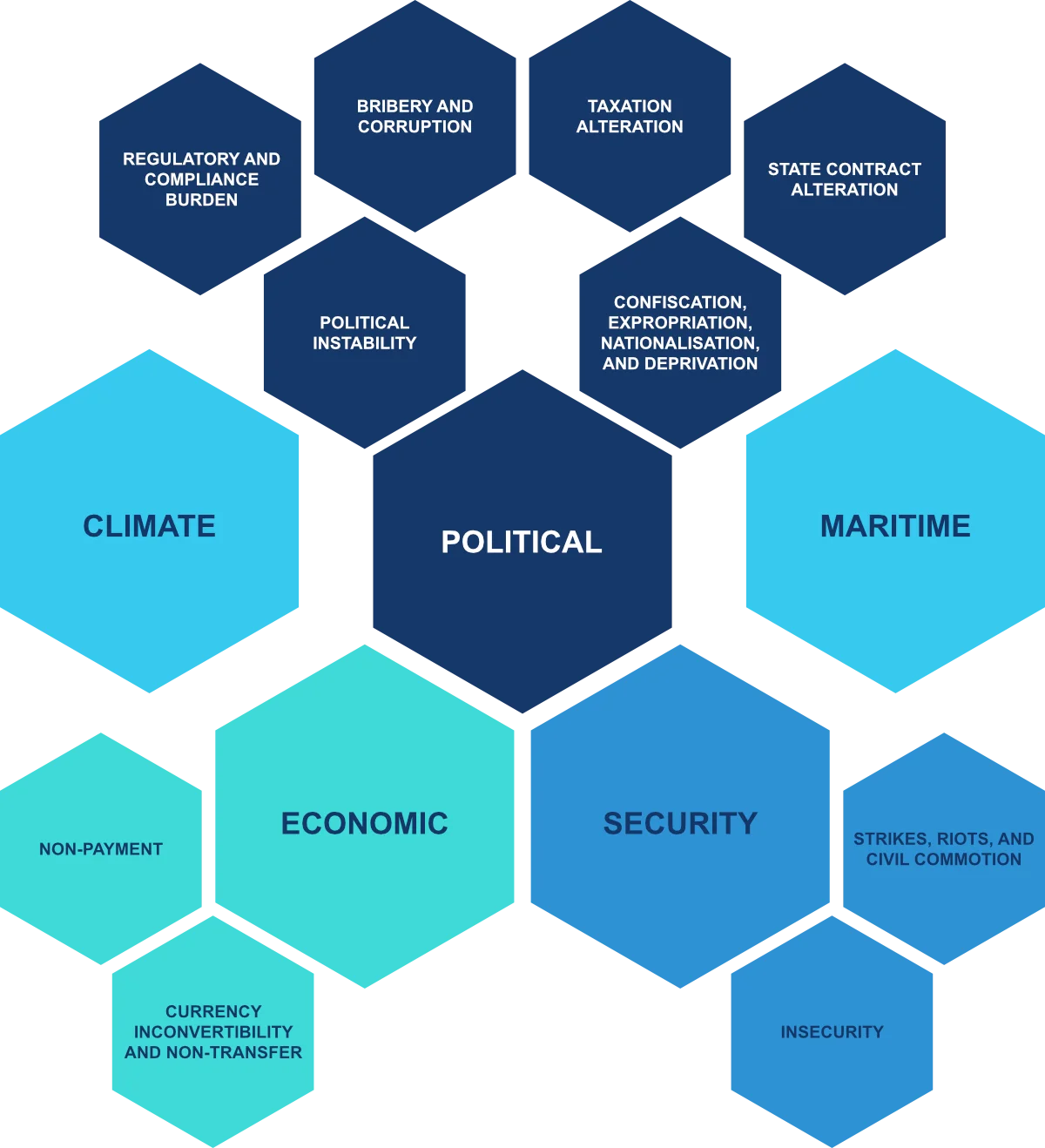

Our specialist country risk solutions consider interconnected risk perils across the political, economic, and security environment.

We track indicators, map scenarios, and plot the risk trajectory to help you navigate risk and maximise opportunity.

Get The Latest News From Pangea-Risk

Please submit your details to receive our Monthly Newsletter, including complimentary risk analysis, editorial, and infographics.

IN THE NEWS

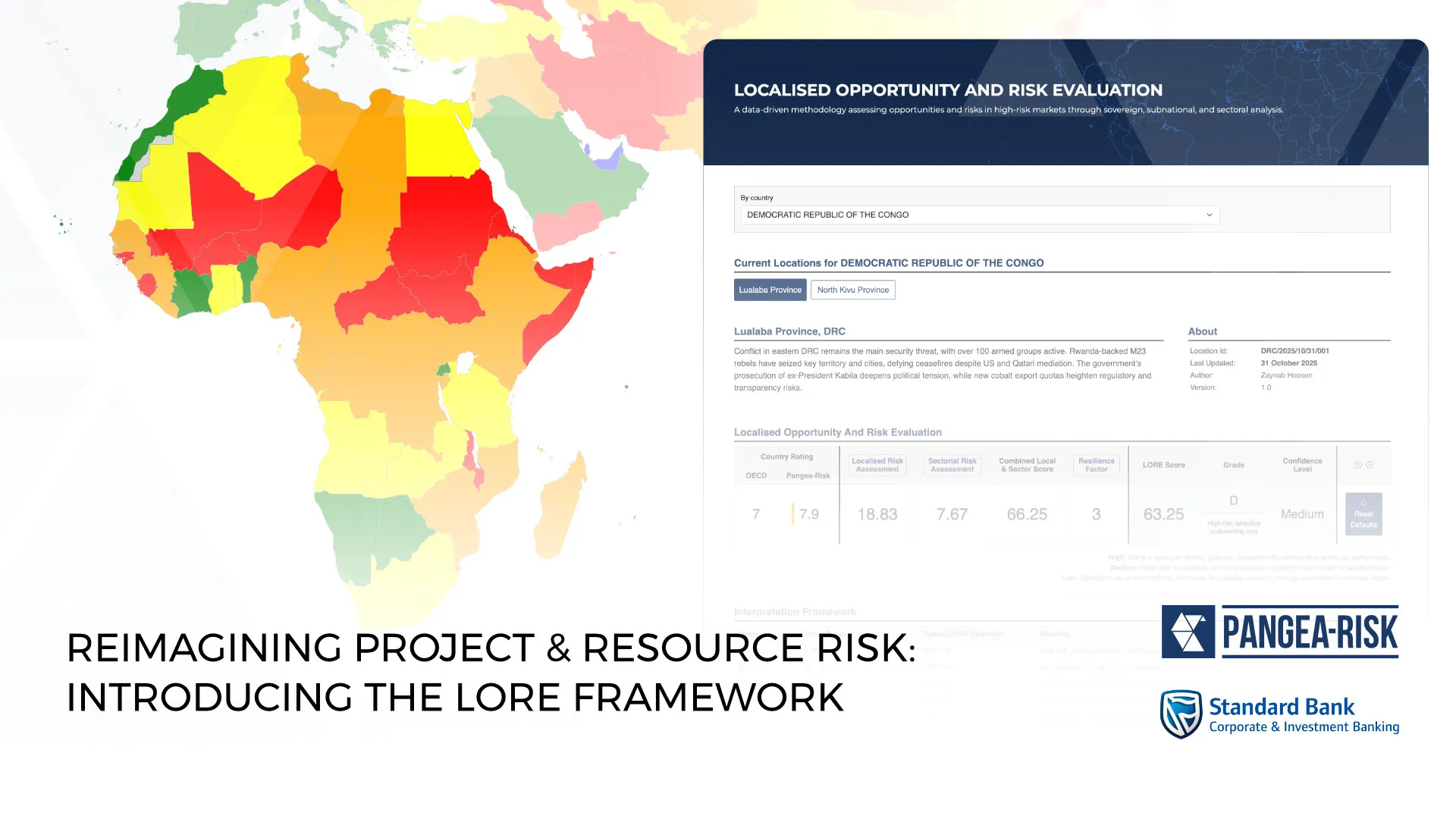

Risks ga-LORE: Accurate credit ratings in emerging markets

Monday, 15 December 2025

Pangea-Risk Advisory team lead Gabrielle Reid shares insights with Trade Finance Global on the new project and resources risk methodology developed jointly with Standard Bank

View the original here

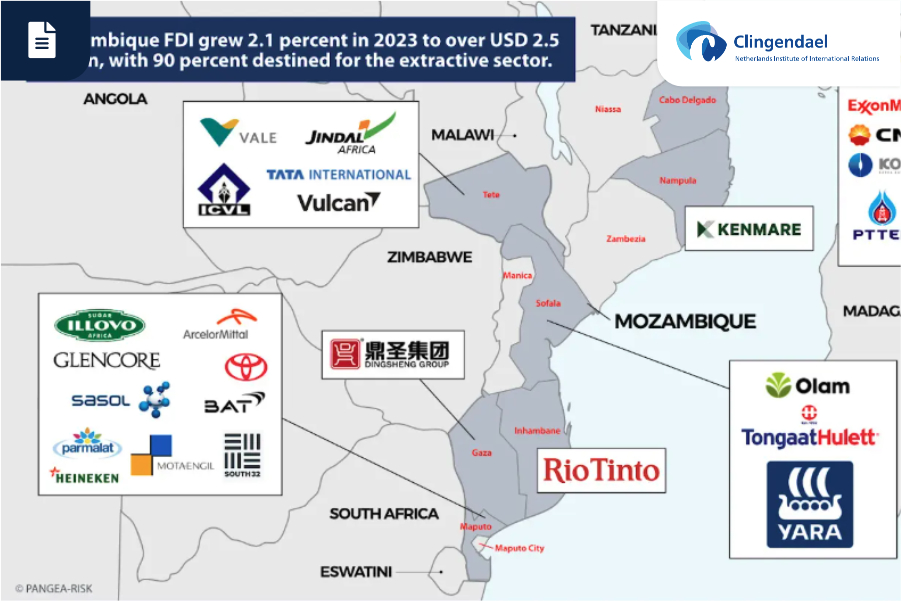

Direct link to Pangea-Risk Advisory report on Mozambique LNG commissioned by Dutch Ministry of Finance

Tuesday, 02 December 2025

Pangea-Risk provided independent specialist intelligence to the Dutch Ministry of Finance on the security situation in northern Mozambique

View the original here

Pangea-Risk advised Dutch Ministry of Finance on decision to withdraw from Mozambique LNG

Tuesday, 02 December 2025

Reuters reporting said the Dutch government had hired specialist intelligence advisory Pangea-Risk as one of two consultancies to advise its decision to withdraw financing from Mozambique LNG

View the original hereSee our latest news

Get the Latest Analysis from Pangea-Risk

Subscribe to our Monthly Insight newsletter and receive free in-depth risk analysis on Africa, the Middle East, and Asia.